Most people have heard of the benefits of naming a 501(c)(3) charity as a beneficiary of their IRA. A planned gift like this is made directly to the qualified charity of your choice from the financial institution that is managing your IRA (called an IRA trustee). That means the gift will not be considered when your estate goes through Probate Court and can often get to the charity quicker and be put to use sooner.

Did you know that you can also make a gift from your IRA while still alive?

Some specific requirements have to be followed, but these are not overly complicated, and the benefit can be significant.

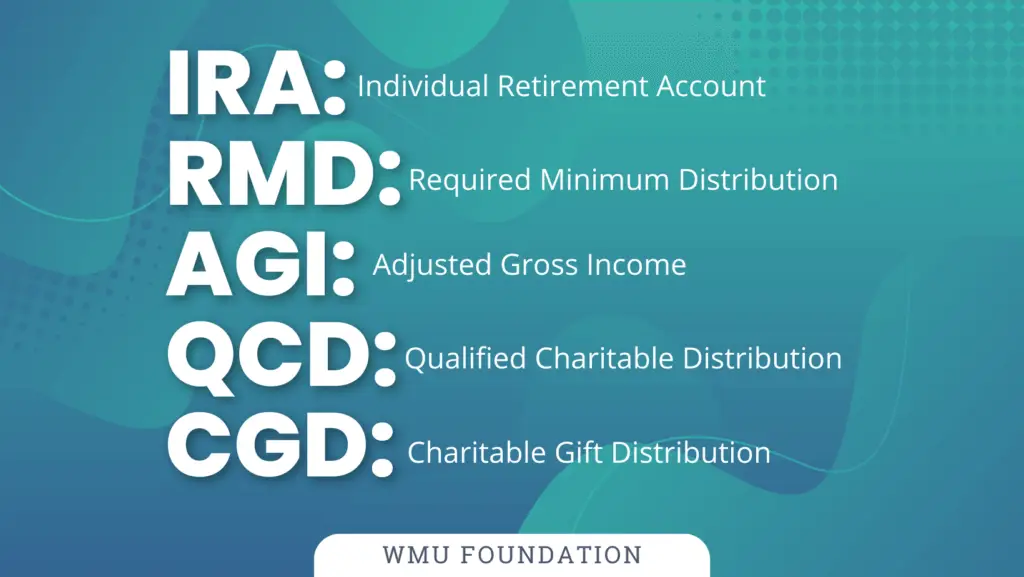

As of January 2023, when you reach age 73 you are required to take a distribution from your IRA. This is called a Required Minimum Distribution (RMD). Prior to this year, the RMD went into effect when you turned 72.

There is an option for individuals drawing money from their IRA and not being taxed on it. Rather than taking the distribution and having it count as part of your Adjusted Gross Income (AGI) for tax filing, you can have the distribution sent directly to a qualified charity. This is called a Qualified Charitable Distribution (QCD) or an “IRA charitable rollover” and is available to anyone age 70½ or older. It is not dependent on you being required to withdraw money from your IRA based on your age.

You can tell the financial institution to send any amount from your IRA directly to a charity. This can be any amount you wish up to a maximum of $100,000 per year.

Whether you itemize your deductions or use the standard deduction when filing your taxes, this giving strategy can be very helpful to you and the charities you support.

What is the benefit to you?

You do not pay tax on any IRA distribution that you give directly to a charity. Also, since you did not take possession of the money, it does not count toward your AGI for tax purposes. This may help you avoid paying higher Medicare premiums or Social Security taxes.

This option only applies to IRAs and does not include a 401k, 403b, or other profit-sharing or pension plans.

Your IRA trustee will send IRS form 1099-R to you for reporting the QCD on your tax return. The key is that you do not take possession of the money, but have your IRA trustee send the distribution directly to a qualified charity. We recommend you consult your own tax advisor before making a final decision about whether or not an IRA charitable rollover works for you.

Let us know how we can help!

If you have any questions about sending IRA distributions to the WMU Foundation or our ministry partners, please contact us at [email protected] or by calling 205-408-5525. You can also learn more by clicking here.

*The age for making a Required Minimum Distribution (RMD) increased to 73 with passage of the SECURE ACT 2.0 in January 2023. The age for making a Qualified Charitable Distribution (QCD) remained at 70½.