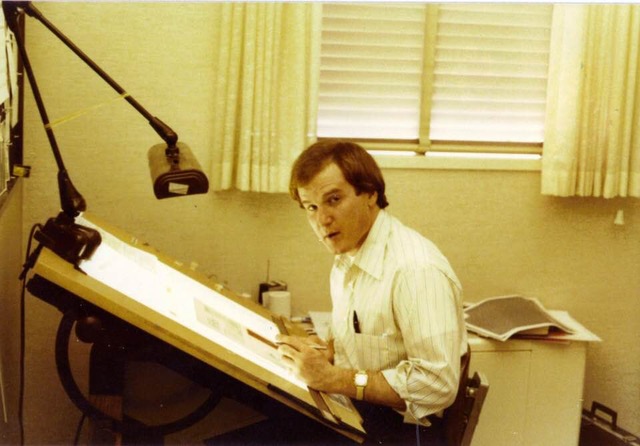

We asked Dick Bodenhamer, former Marketing Team Leader at National WMU, his thoughts on retirement and how he spends his time investing in others.

1. How many years did you spend in your career, and what did you do?

I started my 37-year career at WMU as a 23-year-old graphic designer. After working in this position for 12 years, I moved from the Art Department to doing promotions and finally to marketing. I spent my final years as the Marketing Team Leader for WMU.

2. When you were younger, what did you imagine retirement would be like?

Frankly, retirement seemed so far away it seemed that I would never actually experience it. I remember telling my mother, a retired school teacher, that we have this “retirement thing” all wrong. We should have the freedom of retirement when we are young then work during our twilight years. She actually laughed out loud at that suggestion! My idea of retirement was sleeping late, going out to eat any time I liked, taking extravagant vacations, and generally learning about this fabulous world we live in.

3. What was retirement actually like?

I remember telling my wife, who worked as a school librarian, that since she had experienced a change of pace during the summers for many years, I wanted to take the first few months of retirement to simply do nothing (and she agreed)! I found that sleeping late, meeting friends for lunch, and doing odd chores around the house was good for a little while, but it was overrated. I needed something else to energize and motivate me.

4. How did you know it was time to retire?

My father died when he was 56 and never got to experience retirement; therefore I always had a dream of retiring by the time I turned 55. During that year, the Great Recession hit and, while my wife and I probably could have made it financially, I felt that WMU could use my experience to help navigate those uncertain days, so I postponed retirement for another five years. As I turned 60, the organization seemed to be regaining its footing, and in some areas, sales were up, so I seriously started thinking that this was the right time. Also, I knew that my genetic code still could result in premature death, so my wife and I decided that it was time. She and I both retired the same year and have not looked back!

5. Now that you are retired, how do you spend your time?

I still sleep in periodically, but typically spend my days working on gardening, improving our house and yard, and reading great books I didn’t have time to read while working and rearing a family. We enjoy being with our two adult daughters and their husbands, and now we have twin grandchildren (a boy and girl) who occupy some of our time. In addition, I have served in several positions in my church which give me great joy (my favorite is co-teaching an adult Sunday school class). I treasure the freedom to meet friends for lunch and for the potential of taking extended trips with my wife. We have taken at least one two-week trip each year. This is something we could never have done when deadlines pressed on a regular basis. The best part of how my time is spent is that I can decide when and how to use it!

6. How do you invest in others in your retirement?

I have the good fortune of serving as an adjunct professor at Samford teaching two courses: “Family Resource Management” (financial planning for non-business majors) and a business school course, “Financial Management for Nonprofit Organizations.” This opportunity allows me to influence the next generation with lessons I have learned over the course of my life and career. I also have had the opportunity to serve as a marketing/communications consultant with several churches through the Center for Congregational Resources at Samford. I have served as an interim Executive Director for a local nonprofit that serves those mired in poverty, and one of my latest exploits is serving along with our church’s RAs each month as we take responsibility for providing a monthly meal at a local homeless shelter for men. During this phase of life, these engagements are combining elements of my career and interests, bringing together many of the lessons learned throughout life.

data-animation-override>

“During this phase of life, these engagements are combining elements of my career and interests, bringing together many of the lessons learned throughout life.”

7. What advice would you give other retirees about using their time wisely?

In churches and nonprofits, there is often so much that needs to be done, I have noticed is that on the day you retire, you will have a proverbial target on your back! I have friends who accept every opportunity for involvement that comes their way, trading the deadlines and pressures of their career to deadlines and pressures from other people. My advice is: be judicious in saying yes to opportunities for involvement and agree to serve only when the thought of not serving will leave you disappointed. Seek joy in your volunteering! Your service will be more effective.

8. What advice would you give younger people about planning for retirement?

I stress to college students that they have one commodity I no longer have: time. The most important action a young person can do to prepare for retirement is to start investing in their retirement account the day they start their first job! It is proven that small amounts invested early and consistently over their working years will generate much larger returns than far larger amounts of money invested later in life. Regardless of career path, even those in relatively low-pay organizations (such as with nonprofits or church-related professions) can have financial security during retirement with proper planning. This provides freedom to serve others during these special years.

The WMU Foundation has resources to help you retire well and continue investing well (relationally, missionally, and financially). Contact us for more information.